Order Cryptocurrencies Now: Rapid, Secure, and Easy Steps for every single Financier

Order Cryptocurrencies Now: Rapid, Secure, and Easy Steps for every single Financier

Blog Article

Exploring the Advantages and Risks of Purchasing Cryptocurrencies

The landscape of copyright investment is identified by an intricate interplay of compelling benefits and considerable dangers. As we even more take a look at the subtleties of copyright financial investment, it ends up being apparent that informed decision-making is paramount; nevertheless, the question continues to be: How can investors effectively balance these benefits and dangers to secure their monetary futures?

Understanding copyright Fundamentals

As the digital landscape evolves, comprehending the fundamentals of copyright comes to be crucial for possible financiers. copyright is a kind of electronic or virtual money that uses cryptography for safety and security, making it difficult to fake or double-spend. The decentralized nature of cryptocurrencies, usually developed on blockchain technology, improves their protection and transparency, as deals are recorded throughout a distributed ledger.

Bitcoin, produced in 2009, is the very first and most well-known copyright, yet countless options, recognized as altcoins, have actually arised because then, each with unique attributes and purposes. Capitalists must familiarize themselves with key principles, including wallets, which keep personal and public keys essential for deals, and exchanges, where cryptocurrencies can be purchased, sold, or traded.

Furthermore, comprehending the volatility related to copyright markets is crucial, as prices can change considerably within brief periods. Governing considerations also play a substantial duty, as various nations have differing positions on copyright, affecting its use and approval. By grasping these fundamental aspects, potential investors can make enlightened decisions as they navigate the complicated world of cryptocurrencies.

Key Advantages of copyright Investment

Spending in cryptocurrencies uses several engaging benefits that can attract both amateur and knowledgeable financiers alike. Among the primary advantages is the capacity for substantial returns. Historically, cryptocurrencies have exhibited remarkable cost gratitude, with very early adopters of possessions like Bitcoin and Ethereum recognizing considerable gains.

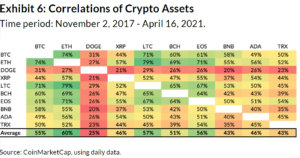

Another key benefit is the diversification possibility that cryptocurrencies offer. As a non-correlated possession course, cryptocurrencies can act as a bush versus traditional market volatility, permitting financiers to spread their threats across numerous investment vehicles. This diversification can improve overall portfolio efficiency.

In addition, the decentralized nature of cryptocurrencies provides a level of autonomy and control over one's possessions that is often doing not have in traditional money. Investors can handle their holdings without intermediaries, potentially decreasing costs and raising openness.

Furthermore, the growing approval of cryptocurrencies in mainstream financing and commerce further strengthens their value proposition. Several services now accept copyright repayments, leading the way for wider adoption.

Last but not least, the technical technology underlying cryptocurrencies, such as blockchain, provides opportunities for financial investment in emerging sectors, consisting of decentralized finance (DeFi) and non-fungible symbols (NFTs), enhancing the investment landscape.

Major Dangers to Consider

Another crucial threat is regulatory unpredictability. Governments around the globe are still creating policies concerning cryptocurrencies, and adjustments in policies can substantially affect market characteristics - order cryptocurrencies. A negative regulative environment could restrict trading and even result in the banning of specific cryptocurrencies

Security dangers likewise posture a considerable hazard. Unlike traditional monetary systems, cryptocurrencies are at risk to hacking and fraudulence. Investor losses can happen if exchanges are hacked or if personal tricks are endangered.

Finally, the absence of consumer securities in the copyright area can leave capitalists at risk - order cryptocurrencies. With limited recourse in case of scams or burglary, people may locate it testing to recover lost funds

Taking into account these risks, detailed study and danger analysis are crucial before involving in copyright investments.

Approaches for Successful Investing

Establishing a robust technique is important for browsing the intricacies of copyright investment. Investors need to start by carrying out comprehensive research to recognize the underlying innovations and market dynamics of numerous cryptocurrencies. This includes remaining notified about fads, regulative developments, and market view, which can substantially influence property performance.

Diversification is another vital technique. By spreading investments throughout several cryptocurrencies, investors can alleviate risks connected with volatility in any type of single property. A well-balanced profile can provide a barrier versus market changes while boosting the capacity for returns.

Establishing clear financial investment goals is vital - order cryptocurrencies. Whether aiming for short-term gains or lasting wealth buildup, defining particular purposes helps in making notified decisions. Carrying out stop-loss orders can also safeguard financial investments from significant slumps, permitting a regimented departure approach

Lastly, constant tracking and review of the investment method is essential. The copyright landscape learn the facts here now is dynamic, and on a regular basis reviewing performance against market conditions guarantees that capitalists continue to be agile and responsive. By adhering to these read here methods, capitalists can boost their chances of success in the ever-evolving world of copyright.

Future Trends in copyright

As financiers improve their techniques, comprehending future patterns in copyright comes to be significantly vital. The landscape of electronic money is evolving rapidly, influenced by technical advancements, regulatory developments, and shifting market dynamics. One significant trend is the rise of decentralized money (DeFi), which intends to recreate typical economic systems using blockchain innovation. DeFi procedures are acquiring traction, offering innovative economic items that might reshape exactly how people involve with their possessions.

One more emerging fad is the expanding institutional passion in cryptocurrencies. As business and financial organizations adopt electronic currencies, mainstream acceptance is most likely to enhance, potentially bring about greater price security and liquidity. Additionally, the assimilation of blockchain modern technology into numerous markets mean a future where cryptocurrencies act as a backbone for deals across fields.

Additionally, the regulatory landscape is advancing, with governments looking for to create structures that balance development and read customer protection. This governing clarity can foster an extra stable financial investment environment. Developments in scalability and energy-efficient agreement devices will attend to problems surrounding deal rate and environmental impact, making cryptocurrencies a lot more sensible for everyday use. Comprehending these fads will be important for capitalists looking to navigate the complexities of the copyright market efficiently.

Final Thought

Report this page